Cash is king for most compensation plans. However, many organizations use non-cash awards, incentives and recognition programs to supplement cash compensation and improve their total rewards programs.

Results from a recent Culpepper Pay Practices and Benefits Survey highlight a variety of different non-cash awards (excluding stock) used by technology and life science companies to recognize and reward employees for service, achievements and performance.

Types of Non-Cash Awards and Recognition Programs

The table below highlights different types of non-cash awards and recognition programs. Gift cards and certificates are the most popular, with 38 percent of companies providing their employees with this type of award. In general, large companies are more likely to use non-cash awards and recognition programs than small companies.

| Table 1: Non-Cash Awards and Recognition Programs | ||||

| Non-cash award and recognition | All | Percent of companies by size | ||

| Up to 100 | 101 to 1,000 | Over 1,000 | ||

| Gift cards/certificates | 38% | 24% | 43% | 42% |

| Merchandise | 19% | 4% | 14% | 38% |

| Dinner | 18% | 6% | 20% | 25% |

| Special trip | 18% | 14% | 18% | 23% |

| Trophy/plaque | 18% | 13% | 16% | 25% |

| Top performer listing | 12% | 4% | 12% | 19% |

| Honorary sales club | 7% | 4% | 2% | 15% |

| Special parking spot | 2% | 0% | 4% | 2% |

Events and Achievements Recognized and Rewarded

Companies typically recognize and reward employees with non-cash awards for long-term service, on-the-spot awards and significant achievements, as highlighted below.

| Table 2: Events and Achievements for Non-Cash Awards and Recognition | ||||

| Reason for non-cash award and recognition | All | Percent of companies by size | ||

| Up to 100 | 101 to 1,000 | Over 1,000 | ||

| Long-term service | 62% | 48% | 58% | 77% |

| On-the-spot award | 61% | 48% | 63% | 68% |

| Significant achievements | 61% | 52% | 67% | 58% |

| High performance | 51% | 39% | 56% | 52% |

| Project completion | 41% | 17% | 44% | 55% |

| Retirement | 19% | 13% | 14% | 29% |

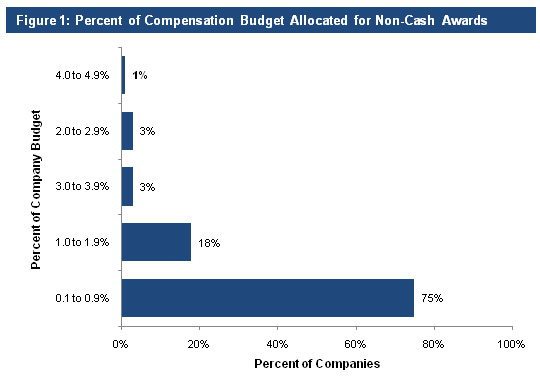

Budget for Non-Cash Awards and Recognition Programs

Most organizations allocate less than 1 percent of their total compensation budget for non-cash awards and recognition programs.

| |

Tax Gross-Ups for Non-Cash Awards

Tax gross-ups enable employees to enjoy the benefits of a non-cash award without having to pay taxes on the value of the award. Thirty-seven percent of organizations provide employees an additional cash payment to cover the tax liability of their non-cash awards.

| Table 3: Tax Gross-ups for Non-Cash Awards | |

| Percent of companies | |

| All companies | 37% |

| Company Size |

|

| 25% |

| 39% |

| 42% |

| Industry Sector |

|

| 39% |

| 29% |

Culpepper and Associates, founded in 1979, conducts worldwide salary surveys and provides benchmark data for compensation and employee benefit programs.

Reposted with permission

Article Source: Culpepper eBulletin, March 2008

Complimentary subscriptions at: http://www.culpepper.com/eBulletin

| Data source: Culpepper Pay Practices and Benefits Survey of 121 organizations. Breakdown by size: Breakdown by sector: Breakdown by country: |

Advertisement

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

Advertisement