Income Inequality Could Drive Demand for Higher Wages

As CEO pay soars, so too does employees' anxiety over their own compensation.

While the Occupy Wall Street protests ended in 2011, the debate on income inequality appears to be far from over. In May 2014, fast-food workers in the U.S. and more than 30 countries walked off their jobs, calling for higher wages and the right to union representation without retaliation. Meanwhile, Thomas Piketty’s controversial Capital in the Twenty-First Century (Belknap, 2014), an economics tome concerned largely with the growth of and the forces behind income inequality, made its unlikely climb up the best-seller list. And President Barack Obama and other politicians are increasingly talking about income inequality. But how much of an impact might the income inequality debate be having on the workplace?

While the Occupy Wall Street protests ended in 2011, the debate on income inequality appears to be far from over. In May 2014, fast-food workers in the U.S. and more than 30 countries walked off their jobs, calling for higher wages and the right to union representation without retaliation. Meanwhile, Thomas Piketty’s controversial Capital in the Twenty-First Century (Belknap, 2014), an economics tome concerned largely with the growth of and the forces behind income inequality, made its unlikely climb up the best-seller list. And President Barack Obama and other politicians are increasingly talking about income inequality. But how much of an impact might the income inequality debate be having on the workplace?

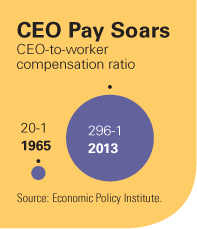

Not surprisingly, the workplace dimension of the debate often concerns executive compensation. A June 2014 analysis of pay data from the Economic Policy Institute calculated that average CEO compensation was $15.2 million in 2013, up nearly 22 percent since 2010. In 1965, the CEO-to-worker compensation ratio was 20-to-1. It rose to roughly 296-to-1 in 2013.

The rise of executive compensation has been a key topic of conversation within the HR field for decades. Much of this discussion involves pay structures and the use of compensation to attract and retain the best senior leaders. While organizations have taken different approaches to setting executive compensation, the trajectory continues to be one of a widening disparity between the pay of senior executives and average workers.

of this discussion involves pay structures and the use of compensation to attract and retain the best senior leaders. While organizations have taken different approaches to setting executive compensation, the trajectory continues to be one of a widening disparity between the pay of senior executives and average workers.

It is difficult to quantify if or how this disparity impacts workplace culture. Most workers in recent years have been happy merely to be employed. And while they may not be deeply focused on pay disparities between their pay and the compensation of their organization’s senior executives, employees overall do appear to be quite anxious about their finances.

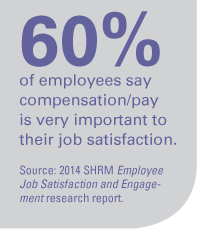

The latest Employee Job Satisfaction and Engagementresearch report from the Society for Human Resource Management (SHRM) found that compensation has become the No. 1 driver of job satisfaction for employees. That is in contrast to the period during the Great Recession and the slow recovery that followed, when job security consistently ranked as the most important factor.

This new emphasis on compensation may be due to increased stress and anxiety by employees about their finances. Employees cited low pay or low pay increases as a major source of stress in the 2013/2014 Staying@Work Report,  which reflects survey responses from officials at nearly 900 organizations in North America, Latin America, Europe and Asia. But the survey, conducted by Towers Watson and the National Business Group on Health, found that so far that concern is going mostly unrecognized by employers.

which reflects survey responses from officials at nearly 900 organizations in North America, Latin America, Europe and Asia. But the survey, conducted by Towers Watson and the National Business Group on Health, found that so far that concern is going mostly unrecognized by employers.

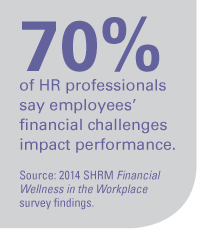

HR professionals, however, appear to be more aware of employees’ financial stress and anxiety. A May 2014 SHRM survey on financial wellness in the workplace, sponsored by McGraw-Hill Federal Credit Union, found that 38 percent of HR professionals said their employees have more personal financial challenges now compared with the early part of the recession in late 2007. Meanwhile, 7 in 10 HR professionals said personal financial challenges have a “large” or “some” impact on overall employee performance.

Looking ahead, HR professionals may increasingly need to deal with the impact of employees’ financial worries. A June 2014 SHRM/Elevate survey on financial stress found that 42 percent of organizations provide financial literacy training to employees about investing and 25 percent provide basic budget training. These numbers could rise if employees’ financial concerns continue to grow. And, of course, rising financial stress and anxiety may translate into more calls for higher pay from employees at all levels.

Looking ahead, HR professionals may increasingly need to deal with the impact of employees’ financial worries. A June 2014 SHRM/Elevate survey on financial stress found that 42 percent of organizations provide financial literacy training to employees about investing and 25 percent provide basic budget training. These numbers could rise if employees’ financial concerns continue to grow. And, of course, rising financial stress and anxiety may translate into more calls for higher pay from employees at all levels.

Jennifer Schramm is manager of the Workforce Trends program at SHRM.

Advertisement

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.

Advertisement