2020 HSA Limits Rise Modestly, IRS Says

Here's what you might not know about HSA contribution rules, and what you should tell employees

2020 vs. 2019 HSA Contribution Limits

| Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans | |||

|---|---|---|---|

| 2020 | 2019 | Change | |

| HSA contribution limit (employer + employee) | Self-only: $3,550 Family: $7,100 | Self-only: $3,500 Family: $7,000 | Self-only: +$50 Family: +$100 |

| HSA catch-up contributions (age 55 or older) | $1,000 | $1,000 | No change |

| HDHP minimum deductibles | Self-only: $1,400 Family: $2,800 | Self-only: $1,350 Family: $2,700 | Self-only: +$50 Family: +$100 |

| HDHP maximum out-of-pocket amounts (deductibles, co-payments and other amounts, but not premiums) | Self-only: $6,900 Family: $13,800 | Self-only: $6,750 Family: $13,500 | Self-only: +$150 Family: +$300 |

| Source: IRS, Revenue Procedure 2019-25. | |||

Contribution limits for various tax-advantaged accounts for the following year are usually announced in October, "except for HSAs, which come out in the latter part of April or May," explained Harry Sit, CEBS, who writes The Finance Buff blog. The contribution limits are adjusted for inflation (rounded to the nearest $50) annually, using the Consumer Price Index for All Urban Consumers for the 12-month period ending on March 31. The catch-up contribution amount, however, is fixed by statute.

While increases in HSA contribution limits are tied to inflation rates, "health care costs continue to outpace inflation, which means Americans will spend more out-of-pocket each year," said Shobin Uralil, co-founder and chief operating office of Lively, an HSA services firm.

Nevertheless, "these new contribution limits will help increase the value of HSAs to individuals and families," Uralil said. "We're seeing growth in HSAs as a vehicle not only for health savings in the near term, but for anticipated health costs in retirement as well."

"While the increases are modest, they are an additional opportunity for Americans to prepare and pay for their health care needs," said Harrison Stone, general counsel at HSA services firm ConnectYourCare. "Annual contribution-limit increases allow HSAs to maintain their value and further grow their role as a key retirement-planning building block."

Employer HSA contributions aren't treated as taxable income but count toward employees' annual contribution limit, Stone noted.

"Employers should consider these limits when planning for the [upcoming] benefit plan year and review plan communications to ensure that the appropriate limits are reflected," advised Damian A. Myers, senior counsel in the employee benefits and executive compensation group at law firm Proskauer in Washington, D.C.

Employer Contributions Rise

Employers contributed more on average to employees' HSAs last year, while the average employee contribution dipped slightly, according HSA investment advisory firm Devenir's 2018 Year-End HSA Market Survey. In January 2019, Devenir collected customer data from the top 100 HSA plan administrators in the U.S., which are primarily banks and financial services firms. Among the findings:

- 2018 employer contributions. The average employer contribution to employees' accounts was $839 (among employers that made contributions), up from $604 in 2017.

- 2018 employee contributions. The average employee contribution was $1,872 (among employees who made contributions), down from $1,921 in 2017.

More organizations also are providing opportunities for employees to "earn" employer contributions by participating in wellness activities, although employers should "keep in mind that there will always be a cohort of employees who will not participate in these types of wellness programs," according to a March 2019 medical trends report from research and advisory firm Gartner and DirectPath, a benefits education, enrollment and health care transparency firm.

The report pegged average employer HSA contributions in 2019 as follows, based on an analysis of more than 1,000 employer health plans in the firms' health plan benchmarking database:

- Single coverage HSA: $1,028.

- Family coverage HSA: $975.

"The key now is to educate employees on the value of these offerings so they can best utilize them—and ultimately drive down health care costs for themselves and for their employers," said Kim Buckey, vice president of client services at DirectPath.

HSA participants who are able to do so should consider contributing up to annual limits "not only to take advantage of the tax savings, but also to ensure that they are putting themselves in a position to better afford their future health care," Uralil said. "Employers can do their part by extending HSA contributions as a benefit to their employees."

HSA Growth Continues

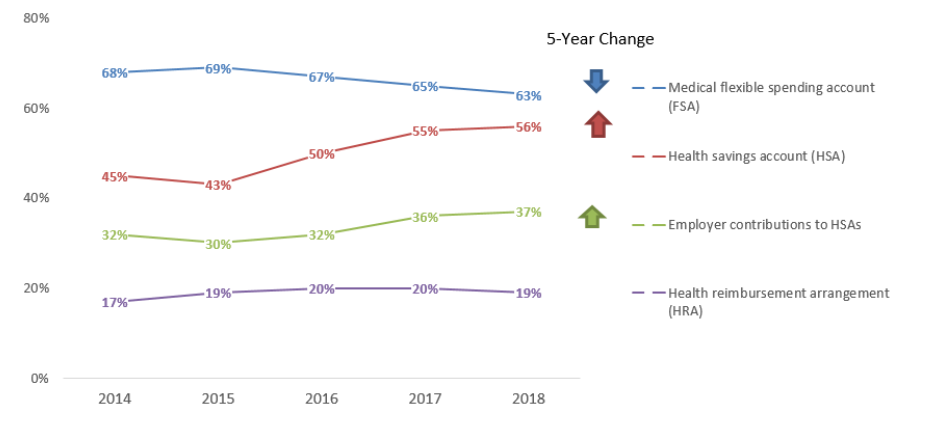

The Society for Human Resource Management (SHRM) 2018 Employee Benefits survey found that last year 56 percent of surveyed SHRM members offered their employees an HSA, up from 45 percent in 2014.

In addition, 37 percent of employers contributed to employees' HSAs, up from 30 percent in 2015.

(Click on graphic to view in a separate window.)

Different surveys show varying results based on methodology and employer samples. For 2019, the Gartner/DirectPath report found that 51 percent of employers offer tax-advantaged reimbursement accounts in conjunction with HDHPs. Of these employers, the vast majority (79 percent) offer HSAs, while 21 percent offer health reimbursement arrangements (HRAs). Roughly 10 percent of employers offer both.

Compliance Considerations

Benefit managers should know and communicate to HSA participants the government's rules on HSA contributions so participants don't find they've run afoul of the contribution rules and face tax fines. Benefit advisors recommend that participant communications and open enrollment materials point out the following:

- HSA account holders can make a catch-up contribution any time during the year in which they turn 55.

- An HSA is in an individual account holder's name, even when used by a spouse or dependents. "There is no joint HSA, even when you have family coverage," Sit said. If only the husband is 55 or older and the wife contributes the full family contribution limit to an HSA in her name, the husband must open a separate HSA in his name to make a catch-up HSA contribution, he explained.

- If both spouses have their own self-only coverage, however, each spouse may contribute up to the annual HSA self-only limit in their own HSA, including catch-up contributions.

- HSA contributions are typically made via pretax deposits through payroll deductions, but participants can instead make after-tax contributions and claim a tax deduction for those. "Either way, these qualifying contributions reduce their taxable income," Stone said. Combined pretax and after-tax contributions must not exceed the annual limit.

- Although the Affordable Care Act (ACA) allows parents to add to their health plans adult children who have not reached age 26, the tax laws regarding HSAs have not changed, and children ages 19 to 26 must be considered a tax dependent for their medical expenses to qualify for payment from a parent's HSA.

- HSA contributions for a given year may be made until the individual's federal tax return due date for that year—generally April 15—without extensions. The HSA administrator must indicate that such contributions are attributed to the prior calendar year.

- HSA holders who lose their eligibility during the year must prorate their annual contribution based on the number of months during which they were HSA-eligible. A month is counted if the employee was eligible to make HSA contributions on the first day of the month.

- Under the last-month rule, those covered by an HSA-eligible health plan on Dec. 1 may contribute the entire year's contribution to their HSA instead of making pro rata contributions by month. Partial-year HDHP enrollees who take advantage of the last-month rule must remain covered by an HDHP through Dec. 1 of the following year or pay taxes on their prior-year HSA contributions.

- The IRS also allows a one-time transfer of IRA funds to an HSA, but that transfer combined with all other HSA contributions made for that year cannot exceed the yearly maximums.

- California and New Jersey do not provide a state income tax deduction for HSA contributions. For employees who file income tax returns in these states, employers should configure their payroll systems to apply state tax withholding—but not federal withholding—to employees' HSA contributions made through payroll deferral.

- New Hampshire and Tennessee tax HSA dividend and interest earnings after a certain dollar amount.

[SHRM members-only HR Q&A: Are employer contributions to an employee's health savings account (HSA) considered taxable income to the employee?]

Recovering Mistaken Contributions

In February, the IRS issued guidance for employers on correcting mistaken HSA contributions. IRS Information Letter 2018-0033 explained that employers may request that a financial institution return funds the employer contributed to a participant's HSA "if there is clear documentary evidence demonstrating that there was an administrative or process error." For instance, an employer could retrieve contributed funds due to:

- HSA contributions that exceeded an employee's payroll election.

- An incorrect spreadsheet or confusion between employees with similar names.

- Contributions incorrectly entered by a payroll administrator.

- Duplicative payroll files transmitted, causing an employee to receive a contribution twice.

- Delayed processing of a payroll withholding change for an employee.

- Disparity between elected annual contributions and the actual number of pay periods.

- A misplaced decimal point.

"Employers should maintain documentation to support their assertion that a mistaken contribution occurred," the IRS advised.

The IRS information letter affords employers "some measure of relief in terms of proceeding to reverse mistakenly granted HSA monies," said Michael Cramer, J.D., a compliance analyst for HUB International, an employee benefits and health insurance broker. However, an employer seeking return of transmitted dollars "will likely need convincing evidence that the contribution was a clear mistake to persuade the IRS, if the reversal is ever questioned," he cautioned. Also, the letter "is by no means binding guidance or regulation," and institutions administering employees' HSAs may not feel legally compelled to adhere to its guidelines, Cramer noted.

ACA's Limits Differ

There are two sets of limits on out-of-pocket expenses for health plans, determined annually by federal agencies, which can be a source of confusion for plan administrators.

The Department of Health and Human Services (HHS) establishes annual out-of-pocket or cost-sharing limits under the ACA for essential health benefits covered under an ACA-compliant plan, excluding grandfathered plans.

The HHS's annual out-of-pocket limits have been slightly higher than those set by the IRS, but to qualify as an HSA-compatible HDHP, a plan must not exceed the IRS's lower out-of-pocket maximums.

On April 25, HHS published the Notice of Benefit and Payment Parameters final rule for 2020 and a fact sheet that summarizes its most significant changes.

Below is a comparison of the two sets of limits.

| 2020 | 2019 |

Out-of-pocket limits for ACA-compliant plans (HHS) | Self-only: $8,150 Family: $16,300 | Self-only: $7,900 Family: $15,800 |

|

Family: $13,800 |

Family: $13,500 |

HSAs and Medicare

Employees turning 65 should also bear in mind that Medicare and HSAs don't mix.

To avoid tax penalties, account holders should stop their HSA contributions six months prior to enrolling in Medicare. This is because once individuals enroll in Medicare, this coverage will be retroactive up to six months before they signed up, but not beyond their initial month of eligibility.

"For employees who turn 65 during the plan year, this is important to be aware of during the prior year's open enrollment," Buckey noted, as it may be necessary for them to stop HSA contributions for the coming year, or at some point during the year.

Employees age 65 or older can continue to contribute to their HSA if they decline to enroll in Medicare while employed with HSA-compatible group health coverage through their employer.

COBRA can also pose Medicare challenges. Employees older than age 65 who deferred Medicare enrollment typically receive an eight-month special enrollment period, starting the month after employment ends or their group health insurance ends, whichever happens first.

Employees should beware that if after ending employment they elect to use COBRA for their insurance for more than eight months (and COBRA coverage is generally available for up to 18 months), then the penalties for missing the special enrollment period and enrolling late are significant and, in the form of higher premiums, continuous.

As a result, using COBRA to delay Medicare enrollment in order to continue contributing to an HSA can be a costly mistake.

Related SHRM Articles:

For Employees Approaching Retirement, Health Coverage Decisions Loom, SHRM Online, November 2019

Employees Still Perplexed by HSA Plans During Open Enrollment, SHRM Online, October 2019

Medicare-Eligible Employees Pose HR Challenges, SHRM Online, February 2019

How to Keep HSAs Exempt from ERISA, SHRM Online, August 2017

Tear Down the Silos Between Employees' HSAs and 401(k)s, SHRM Online, June 2017

Other 2020 Inflation-Adjusted Limits/Thresholds

2020 Benefit Plan Limits and Thresholds Chart, SHRM Online, November 2019

401(k) Contribution Limit Rises to $19,500 in 2020, SHRM Online, November 2019

2020 FSA Contribution Cap Rises to $2,750, SHRM Online, November 2019

2020 Payroll Taxes Will Hit Higher Incomes, SHRM Online, October 2019

PBGC Raises Pension Premium Rates for 2020, SHRM Online, October 2019

IRS Lowers Employer Health Plans' 2020 Affordability Threshold, SHRM Online, July 2019