401(k) Sponsors Focus on Benchmarking—and Lowering—Fees

Benchmarking plan fees every few years provides negotiating leverage

Keeping participant fees in check has become a primary focus of defined contribution plan sponsors, new research shows. Benchmarking fees against what similar plans are paying can provide leverage when negotiating with service providers.

The number of employers that calculated 401(k) and similar plan fees last year rose to 83 percent, up from 79 percent in 2016, according to institutional investment firm Callan's 2018 Defined Contribution (DC) Trends Survey report. Responses were received from 152 large plan sponsors surveyed last fall.

After reviewing their plan management and investment fees, 40.5 percent of plan sponsors took actions such as renegotiating fees with the financial services firm administering their plans or replacing high-cost investment funds with lower-cost alternatives.

"We expect to see continued pressure on fees in 2018—both administrative and investment management fees," said Jamie McAllister, senior vice president at Callan. She noted that:

- Just over 50 percent of sponsors intend to renegotiate administrative fees for record-keeping and other plan services this year.

- About 40 percent expect to renegotiate investment management fees.

Despite the focus on reining in fees, "plan sponsors surprisingly didn't rank fee communications [with plan participants] as a high priority," McAllister said. She advised that they do so.

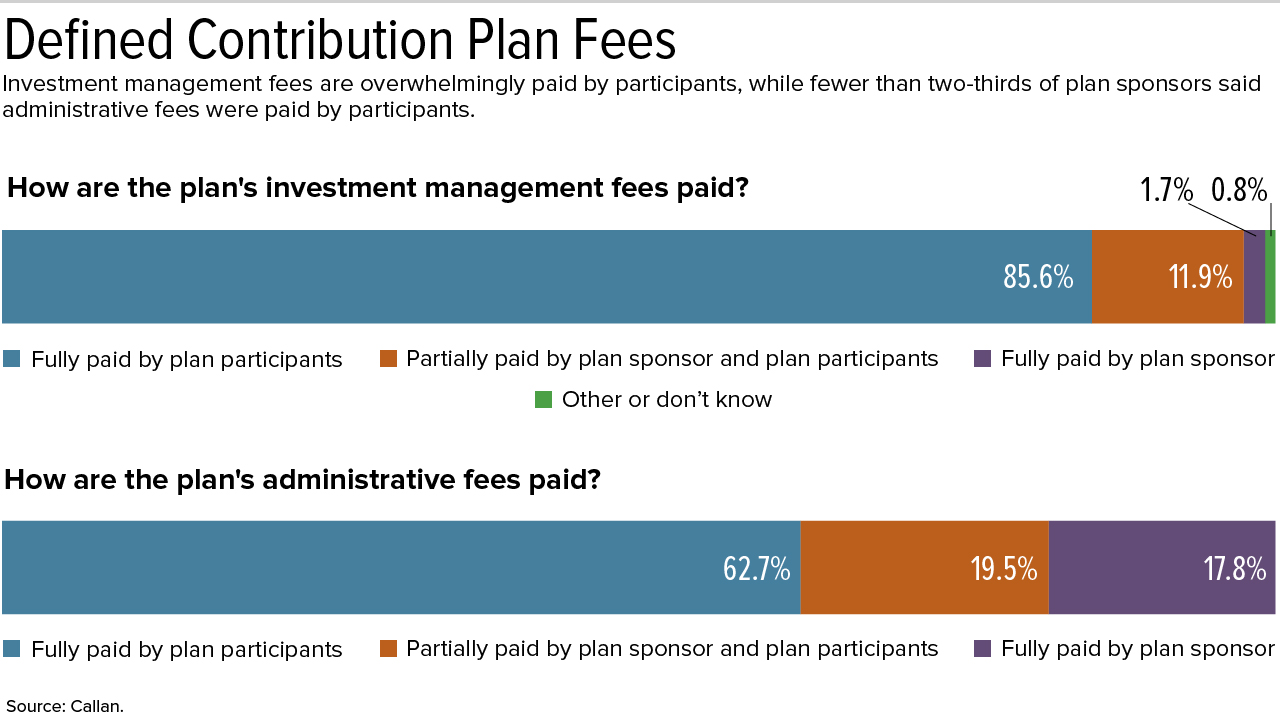

Investment management fees, typically expressed as fund expense ratios, are overwhelmingly paid by plan participants and deducted from their fund assets. The payment of plan administration fees is a bit more complex, the survey found.

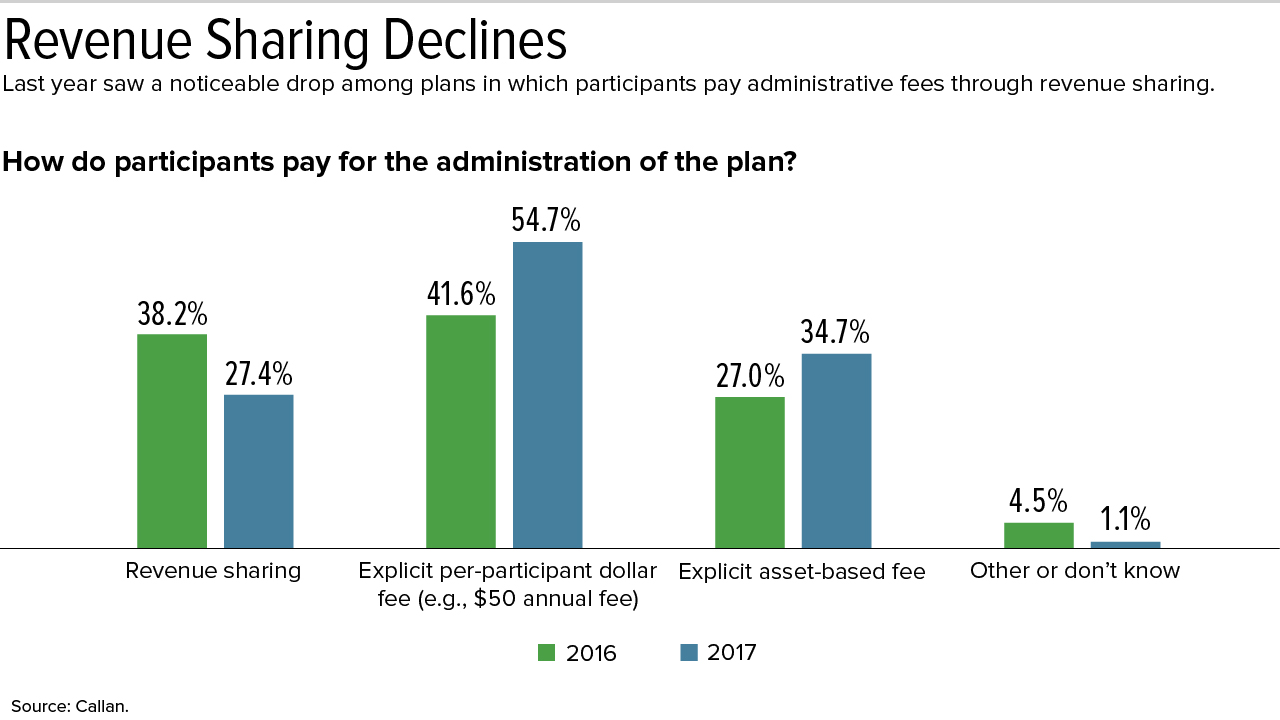

Revenue Sharing Is Less Popular

The number of plan sponsors using mutual-fund revenue sharing to pay plan administrative expenses continues to decline, the survey found, dropping to 27.4 percent last year from 38.2 in 2016.

Revenue-sharing arrangements involve the transfer of revenue from select investment funds to service providers, typically through so-called 12b-1 fees, to offset plan expenses.

Asset-Based vs. Participant-Based Fees

Of those plans that are paying plan administration costs solely through an explicit fee, using a per-participant fee continues to be more popular than an asset-based fee, Callan found.

That finding, however, is at odds with recently published results from a 2016 survey of 590 defined contribution plans by the Plan Sponsor Council of America (PSCA), an employers group. PSCA found that:

- 43 percent of plans were charged a fee based on a percentage of plan assets for record-keeping and administration services.

- 34.4 percent of plans paid a flat rate per participant for these services.

One explanation for the different findings is that Callan's survey predominantly sampled large plans as compared with the PSCA survey. If a plan has over $100 million in assets, for instance, as asset-based fee of only a few basis points could end up being excessive.

More than half of companies conduct a formal review of fees annually, PSCA found, and 30.3 percent review them more frequently.

[SHRM members-only toolkit: Designing and Administering Defined Benefit Retirement Plans]

Benchmarking Plan Fees

"As a plan sponsor, you are required to understand all of the fees that are associated with your organization's retirement plan benefit program," Ed Lynch, founder and CEO of Fiduciary Plan Governance, an employee benefits consultancy in Newbury, Mass., explained in a recent blog post. This is a challenge, he wrote, because "plan fee structures are often opaque, complicated (needlessly so) and, sometimes, downright misleading."

Plan sponsors are "also required to ensure the services for which the plan is paying are necessary, meaning the plan wouldn't function (or function as well) without them, and reasonable," he wrote. "Taken together these are one aspect of the 'expert standard' you are expected to meet to fulfill your plan management responsibilities."

The most effective way to meet this fiduciary requirement—and thereby to protect the plan from an excessive-fee lawsuit by plan participants—is by engaging in a request for proposals every three to five years, Lynch advised.

"The 401(k) and 403(b) markets are extremely competitive," he noted. While only a fraction of plans placed out to bid each year end up changing service providers, the process gives plan sponsors information with which to negotiate a better deal with their current providers, Lynch said.

A Range of Fees

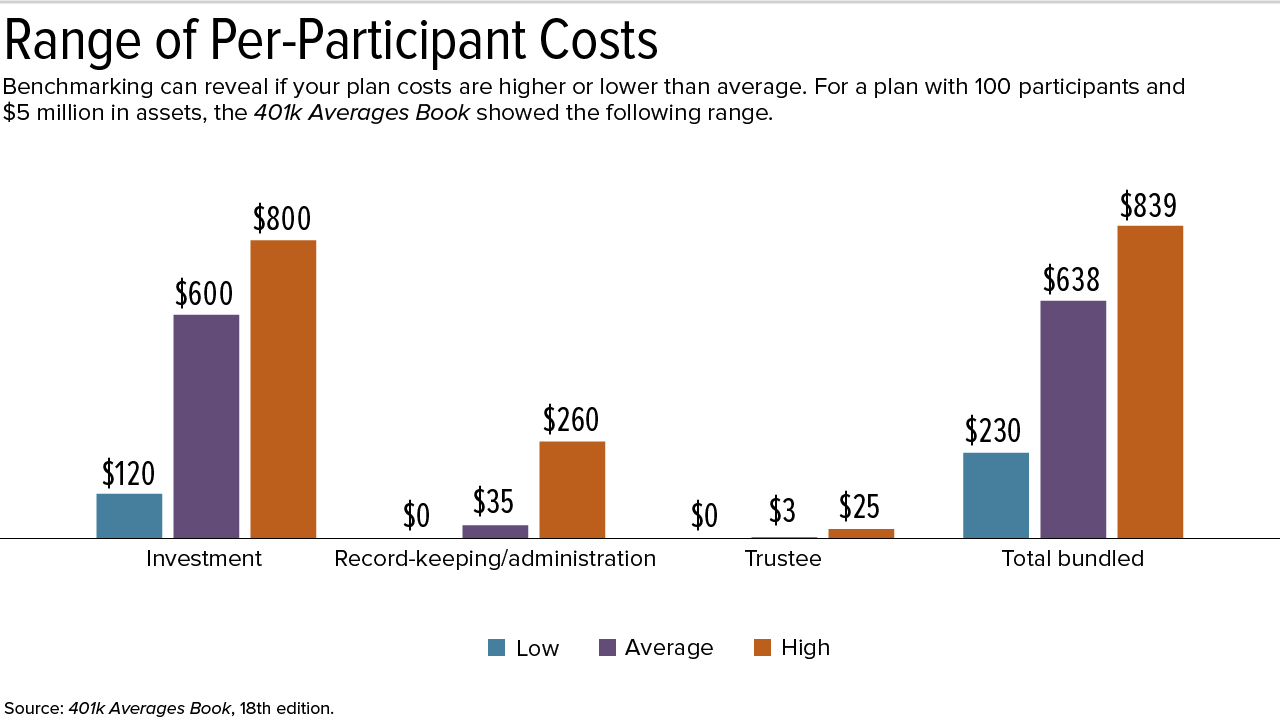

According to the 2018 edition of the 401k Averages Book, a benchmarking guide, for a plan with 100 participants and $5 million in assets, average costs per participant last year were:

- Investment management: $600

(1.2 percent of assets per participant)

- Record-keeping/administration: $35

(0.07 per of assets per participant)

- Trustee costs: $3

(less than 0.01 percent of assets per participant)

Combined, the average total bundled cost would be $638, or 1.28 percent of assets per participant.

As the chart below shows, the fees charged for providing services to plans of this size can be substantially higher or lower than the average.

Plan sponsors should benchmark their plan against those with similar characteristics, given that costs vary based on the number of participants and total assets, decreasing on a per-participant basis for larger plans. Fees much higher than the average for a similarly sized plan should be scrutinized.

Benchmarking Beyond Fees

Don't concentrate solely on benchmarking fees to the exclusion of other metrics, advised Michael Webb, CEBS, vice president at Cammack Retirement Group, a consultancy in New York City.

"This is not to say that benchmarking of fees is not extremely important," he noted. "It is, and plan sponsors should absolutely be comprehensively benchmarking fees. However, prudent plan sponsors will cover all of their bases by benchmarking other measures of a plan's success as well."

Plan sponsors that are not already doing so should consider benchmarking:

- Overall plan asset growth. "Arguably, this is the most important measure of a plan's success," Webb said. "A plan could have the lowest-cost fee structure on the planet, but if it is not growing sufficiently, then the primary purpose of the plan—to provide sufficient retirement income—may not be fulfilled."

- Average account balance. This is an important measure for two reasons. First, it can have a significant impact on fees, as plan administration firms (record keepers) generally price plans with higher average account balances far more favorably, Webb noted. Second, "the average account balance can serve as an overall measure of the degree to which plan participants are accumulating sufficient assets for retirement."

- Projected income replacement ratios at retirement. Generally expressed as a percentage of salary for each participant in the plan, "this illustrates the extent to which individual participants are—or are not—on track to retire with sufficient income," Webb pointed out. By breaking down these figures by age/service, salary level and other parameters, "plan sponsors can target those employees who may not be accumulating sufficient assets with customized engagement campaigns."

Related SHRM Articles:

401(k) Plan Enhancements and Falling Fees Linked to Richer Retirements,SHRM Online, February 2019

Renegotiated 401(k) Plan Fees Fall to All-Time Low, SHRM Online, October 2016

Fearing Lawsuits, 401(k) Plan Sponsors Are Focused on Fees, SHRM Online, May 2016

Fee Allocation in 401(k) Plans: Choose Your Model, SHRM Online, February 2016

401(k)s Shifting to Fixed-Dollar, Per-Head Fees, SHRM Online, October 2015

An organization run by AI is not a futuristic concept. Such technology is already a part of many workplaces and will continue to shape the labor market and HR. Here's how employers and employees can successfully manage generative AI and other AI-powered systems.