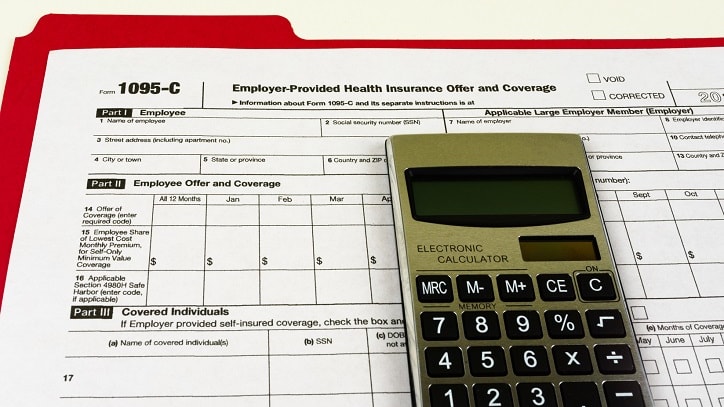

Congress Considers 'Commonsense Reporting Act' to Streamline ACA Filings

Reforms could reduce employers' compliance burdens

Was this resource helpful?

As a SHRM Member®, you’ll pave the path of your success with invaluable resources, world-class educational opportunities and premier events.

Build capability, credibility, and confidence to influence strategy, shape culture, and drive measurable business impact.

Demonstrate your ability to apply HR principles to real-life situations.

Stand out from among your HR peers with the skills obtained from a SHRM Seminar.

Demonstrate targeted competence and enhance your HR credibility.

Designed and delivered by HR experts to empower you with the knowledge and tools you need to drive lasting change in the workplace.

Gain a deeper understanding and develop critical skills.

Demonstrate your ability to apply HR principles to real-life situations.

Attend a SHRM state event to network with other HR professionals and learn more about the future of work.

Stand out from among your HR peers with the skills obtained from a SHRM Seminar.

Learn live and on demand. Earn PDCs and gain immediate insights into the latest HR trends.

Stay up to date with news and leverage our vast library of resources.

Designed and delivered by HR experts to empower you with the knowledge and tools you need to drive lasting change in the workplace.

Easily find a local professional or student chapter in your area.

Post polls, get crowdsourced answers to your questions and network with other HR professionals online.

Learn about SHRM's five regional councils and the Membership Advisory Council (MAC).

Learn about volunteer opportunities with SHRM.

Shop for HR certifications, credentials, learning, events, merchandise and more.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus convallis sem tellus, vitae egestas felis vestibule ut.

Error message details.

Request permission to republish or redistribute SHRM content and materials.

Reforms could reduce employers' compliance burdens

Earning your SHRM-CP credential makes you a recognized expert and leader in the HR field.

Learn how Marsh McLennan successfully boosts staff well-being with digital tools, improving productivity and work satisfaction for more than 20,000 employees.

The proliferation of artificial intelligence in the workplace, and the ensuing expected increase in productivity and efficiency, could help usher in the four-day workweek, some experts predict.

As artificial intelligence technology continues to develop, the demand for workers with the ability to work alongside and manage AI systems will increase. This means that workers who are not able to adapt and learn these new skills will be left behind in the job market.

Stay up to date with the latest HR news, trends, and expert advice each business day.

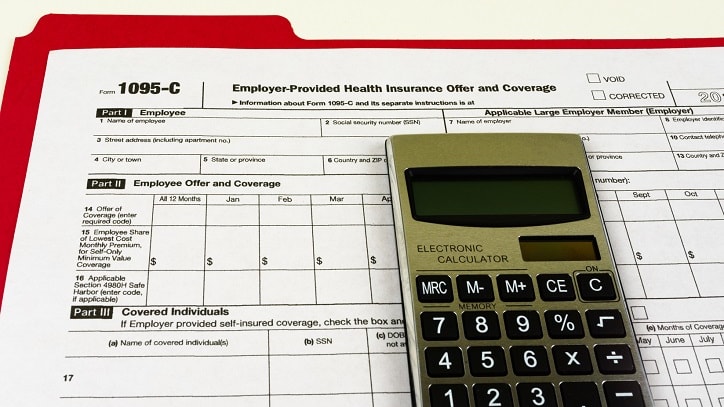

Success caption